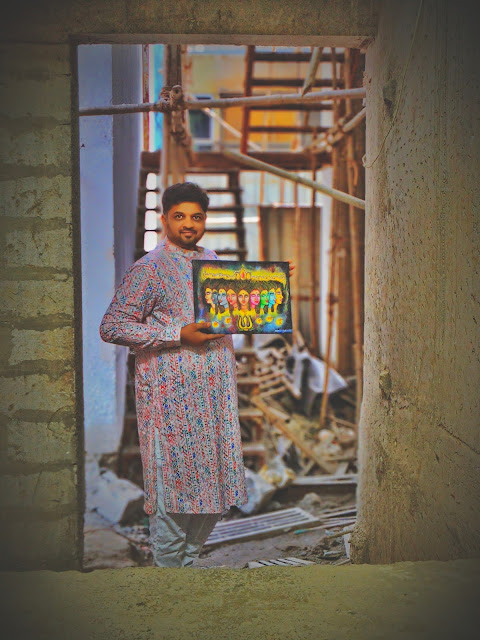

Real Estate and Art Investment as "Eating in Gold" | By Nikhil Pattani

Investing in Art and Real Estate: A Growing Trend in India

In recent years, investing in art and real estate has gained immense popularity among individuals looking to diversify their investment portfolios in India. As the art market in the country continues to grow and evolve, it presents several advantages for investors. Simultaneously, real estate investment provides people with opportunities to grow their wealth and secure their financial future. Let's explore how both these investment avenues are making a mark and bringing new opportunities for investors:

Investing in Art in India:

1. Rising trend: The Indian art market has witnessed a significant surge in recent times, attracting both domestic and international investors. This growing trend can be attributed to increasing awareness and recognition of Indian artists, their unique styles, and the appreciation in the value of art assets.

2. Advantages of art investment: Art offers multiple advantages to investors. Firstly, it acts as a tangible asset that holds aesthetic and emotional value, allowing investors to enjoy their investment while preserving its worth. Additionally, art investments also serve as a hedge against inflation and market volatility, ensuring stability in an investor's portfolio.

3. The evolving art scene: The Indian art scene has experienced a transformation with the emergence of new artists, diverse contemporary artworks, and a thriving auction market. Art fairs, galleries, and exhibitions have become institutionalized, attracting art enthusiasts, collectors, and investors alike.

4. Statements from Indian art experts:

- Dr. Pramod K. Goyal, a renowned art collector, suggests that investing in art provides an opportunity to support and uplift Indian artists while gaining long-term financial benefits.

- Shakti Maira, an artist and author, believes that Indian art offers diversity, uniqueness, and potential for significant appreciation, making it an attractive investment option.

Real Estate Investment:

1. Wealth creation: Real estate investment has been a proven method of wealth creation over the years, offering stable returns and capital appreciation. India's booming real estate sector, coupled with various government initiatives, has attracted investors seeking long-term growth opportunities.

2. Asset appreciation: One of the significant advantages of real estate investment is its potential for asset appreciation. As land becomes scarce, property values tend to rise, providing investors with substantial profits over time.

3. Rental income: Investment properties can generate a steady stream of passive income through rental returns. This income not only helps investors cover property expenses but also serves as an additional source of income.

4. Security and diversification: Real estate investments provide a sense of security as land and properties are physical assets that hold inherent value. Additionally, diversifying investment portfolios with real estate allows individuals to safeguard against market fluctuations and reduce risk.

Art Investment as "Eating in Gold":

Investing in art is often equated to "eating in gold" due to its perceived exclusivity and appreciation potential. Just as consuming gold is a symbol of luxury and wealth, investing in art is considered a prestigious venture that can yield significant returns. Indian art offers a unique blend of traditional and contemporary styles, providing investors with an opportunity to appreciate the cultural heritage while growing their wealth steadily.

In conclusion, both art and real estate investments have garnered attention in India as avenues for growth and diversification. As the Indian art market continues to flourish and the real estate sector maintains its upward trajectory, investors are presented with opportunities to secure their financial futures. Whether through investing in art or real estate, individuals can tap into the advantages offered by these asset classes and embark on a journey towards long-term wealth creation.

No part of this publication may be reproduced , stored in a retrieval system or transmitted , in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner.

Copyright infringement is never intended, if we published some of your work, and you feel we didn't credited properly, or you want us to remove it, please let us know and we'll do it immediately.

Comments

Post a Comment